putnam county property tax bill

100 South Jefferson Avenue Suite 207 Eatonton GA 31024 706-485-5441 Fax 706-485-2527 Pamela K. Home Shopping Cart Checkout.

Putnam County Ohio Tax Map Department

Putnams Tax Collector Linda Myers and staff are always ready.

. Putnam County Property Tax Facts. If you have not received a tax bill by July 25th of any year you should call the tax office and request a bill. Other duties of this office include issuing titles and registrations to motor vehicles and boats and the sale of occupational licenses fishing licenses and hunting licenses.

A property tax calculator is available to estimate the property tax due for any appraised value. Account info last updated on May 2 2022 0 Bills - 000 Total. The 2021 City of Cookeville Property Tax Rate is 082 per 100 of assessed value.

All Debit Cards 395. 40 Gleneida Ave Room 104 Carmel NY 10512. You may reach the tax office at 304 586-0204 or goggle Putnam County Tax Lookup.

This site provides government information and services economic development resources and more. Click above to pay your Putnam County Property Taxes. Get free info about property tax appraised values tax exemptions and more.

Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204. 001 - Hennepin Senachwine Multi-Township Assessor 005 - Unit School District 005 115 - Grade School District 115 500 - High School District 500 513 - Junior College 513 535 - Unit School District 535 C001 - Putnam County GHMF - Granville - Hennepin Fire. T04R - Magnolia Township R B.

Convenience fees All Major Credit Cards Accepted 245. About Contact Us. Unpaid tangible personal property accounts begin accruing interest at a rate of 1 ½ per month.

The Town of Putnam uses Invoice Cloud for anyone choosing to pay their real estate business personal property or motor vehicle tax payments with credit card debit card savings account or checking account transfer. Which may lower the propertys tax bill. In other words the current year.

The official website of Putnam County Indiana. Revenue Bill Search Pay - Town of Putnam. 2022 Tax Rate.

Enter Taxpayer Account Number. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non-ad valorem assessments which are levied for functions such as storm water utility solid waste collections or fire and rescue. Access Indiana Indiana Business Research Center Out of State Sex Predator Locator State Government Phone Numbers State Government.

For more information please visit Putnam County. Ad Find County Property Tax Info For Any Address. Tax bills will be prepared and mailed during the month of July in the year following the year mentioned above.

Online Property Tax Payment Enter a search argument and select the search button. TFD - Tiskilwa Fire District. Official Putnam County Illinois website features interactive maps for economic development government minutes agendas county departments.

Putnam County Property Taxes become delinquent April 1 of the year of assessment at which time a 3 penalty is added to the real estate tax bill. Mastercard Visa Amex and Discover can be used on Invoice Cloud as well as any debit card backed by these companies. Taxes must be paid by 10-24-16 to avoid newspaper.

There are two major factors that influence the amount of real estate taxes you pay the value of your property as determined by the Putnam County Auditor and tax levies most of which are approved by the voters. Please call our office at 931-520-5250 or 931-520-5251 for the exact amount of tax due. If you are with a Bank or Mortgage Company please use our GovTech property tax.

Each November 1st the Tax Collector opens the tax rolls and mails tax bills to the owner of record from the beginning of the calendar year. Enter Tax Year and Ticket Number and suffix. Putnam County Property Appraiser.

These are deducted from the assessed value to give the propertys taxable value. Click here for an explanation. Property Tax Statement Info.

You must have your tax bill with you to pay at these locations. Putnam Country Tax Assessors Office Website. 2022 MANUFACTURED HOME Tax Due Dates.

3 penalty and advertising fee applies to unpaid real property taxes. In Florida Property Appraisers are independent constitutional officers duly elected from their counties of residence by their fellow citizens and. Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204.

Putnam County Treasurers Office. Any tax payer wishing to participate in the installment plan must turn their application in by April 30th if you are currently on the installment plan there is no need to re-apply. Tax bills are mailed on July 15th of each year.

Tax Rolls. Taxes paid after the month of April must be paid with guaranteed funds. A valuable alternative data source to the Putnam County IN Property Assessor.

View Cart Checkout. Real Property Tax Service Agency Putnam County New York. The Putnam County Indiana Treasurers Office is responsible for the collection and management of county taxes as well as other financial duties.

TIF01 - Granville TIF. Enter Taxpayer Name last first. EASY WAY TO PAY.

Putnam County Trustee S Office

2020 Putnam County Tax Sale Auction Putnam County Online

Putnam County Tax Assessor S Office

Putnam County Florida Property Search And Interactive Gis Map

Pregnant In Putnam County Is Temporarily Losing Its Only Birth Center

Putnam County Tax Assessor S Office

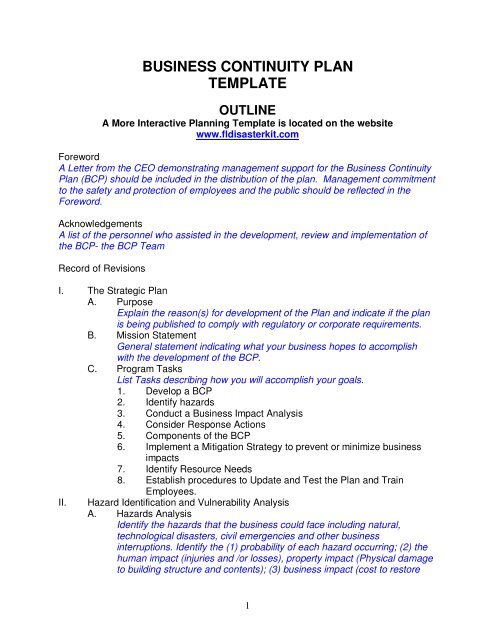

Business Continuity Plan Template Putnam County Florida Chamber

Putnam County To Send Out Revised Tax Bills

Putnam County Gov Putnamcountygov Twitter

Parcel Search Image Mate Online

Putnam County Ohio Tax Map Department

State Of The County Address 2022 Putnam County Online

Putnam County Property Tax Inquiry

April S Marketwatch Is In Look At That Interest Rate Indiana Marketing Things To Sell